The GiveDirectly Blog

Read updates from our team on the latest research, program learnings, and more.

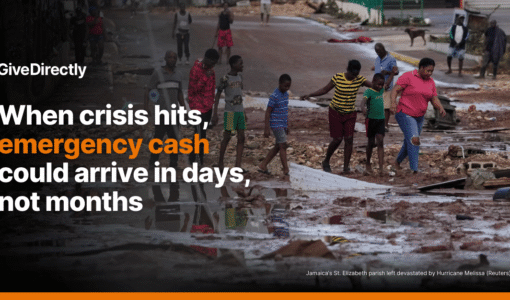

When crisis hits, emergency cash could arrive in days, not months

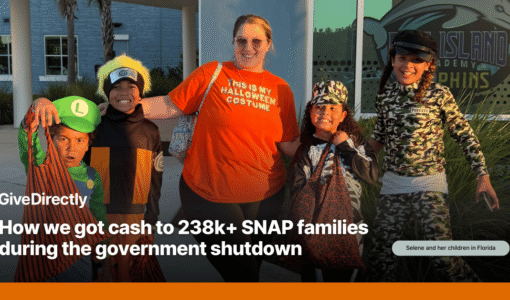

How we got cash to 238k+ SNAP families during the government shutdown

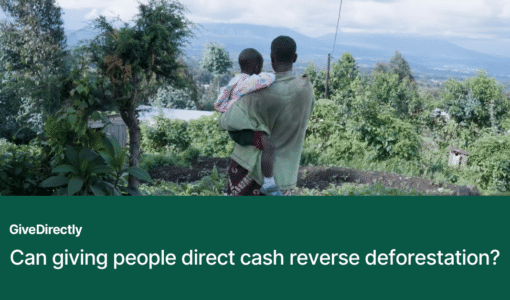

Can giving people direct cash reverse deforestation?

What giving people money doesn’t fix

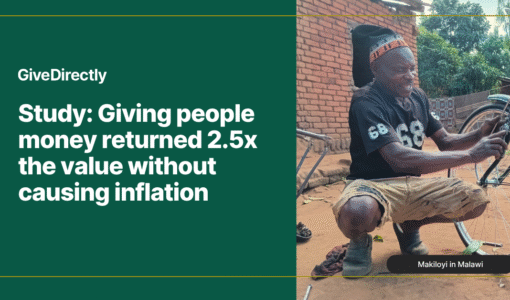

Study: Giving people money returned 2.5x the value without causing inflation

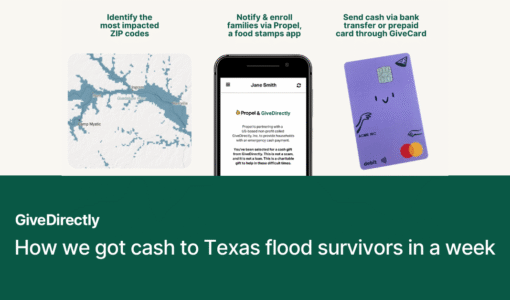

How we got cash to Texas flood survivors in a week

When staying quiet backfired: how we rebuilt trust in Mozambique

Can cash accelerate the end of extreme poverty? Taking the next big step in Malawi

Oyin Solebo joins GiveDirectly Board of Directors

New research: Cash for pregnant moms in Flint led to healthier births and millions in healthcare savings