Ways of Charitable Giving

Guide to donor-advised funds

Donor-advised funds (DAFs) can be a flexible and tax-efficient way for you to give to the charitable cause of your choice while making a philanthropic impact.

Here’s an overview to help you understand the pros and cons of DAFs and whether it could be the right fit for your needs.

- What is a DAF

- How does a DAF work

- How to set up your DAF

- The tax benefits and implications, including advantages and disadvantages of DAFs

- Common criticisms of DAFs

- Major DAF providers

- Frequently asked questions about DAFs

This content is specific to U.S. tax law – refer to IRS Publication 526 for more information and official guidance. You should consult with a financial advisor or tax professional for advice on your individual situation before making any investment decisions.

What is a donor-advised fund (DAF)?

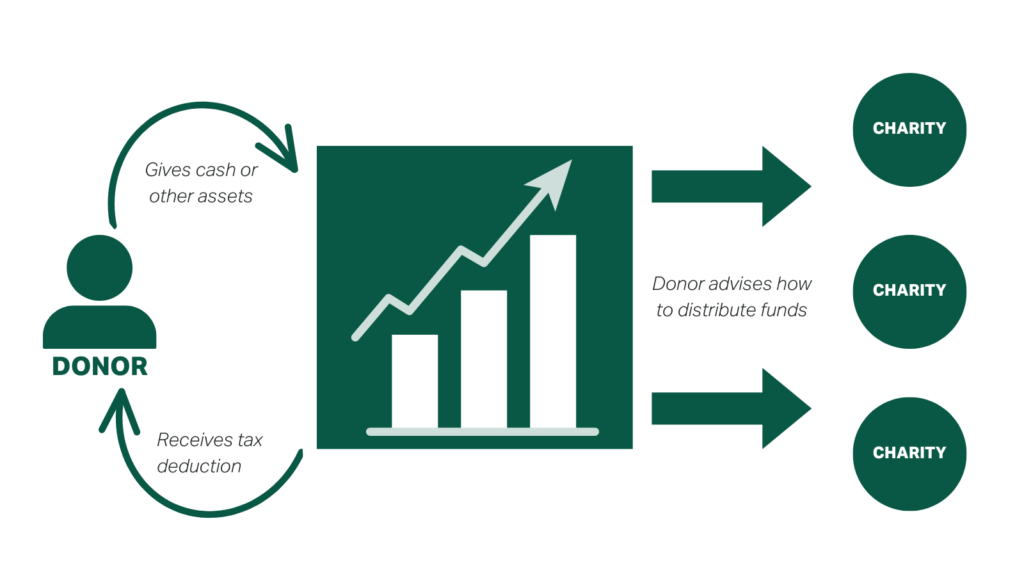

A DAF is a philanthropic investment account that enables you to support the charity of your choice and take an immediate tax deduction on the full amount of your contribution, then distribute that contribution at a later date. You also have the option of investing your contribution in stocks, mutual funds, and other investment vehicles to grow your contribution tax-free while recommending grants from the fund to qualifying charities over time.

How does a DAF work?

You can donate cash, securities, real estate, or other financial assets to a donor-advised fund, which is administered by a third party. Those funds can then be sent directly to any IRS-qualified charitable organization of your choice or invested tax-free until you’re ready to give.

How to set up a DAF

Here’s an overview of the basic steps you may need to take when setting up a DAF.

1. Select the best donor-advised fund provider for your needs

Here are some factors to consider:

- What types of assets you can contribute: DAFs commonly accept assets like checks, bank wires, and bank transfers. If you intend to donate any of the following non-cash assets, you should confirm which sponsors will accept them:

- Mutual fund shares

- Stocks and bonds

- Private equity and hedge fund interests

- Cryptocurrencies

- Partnership interests

- Life insurance

- Trusts

- Real estate

- Other investment assets

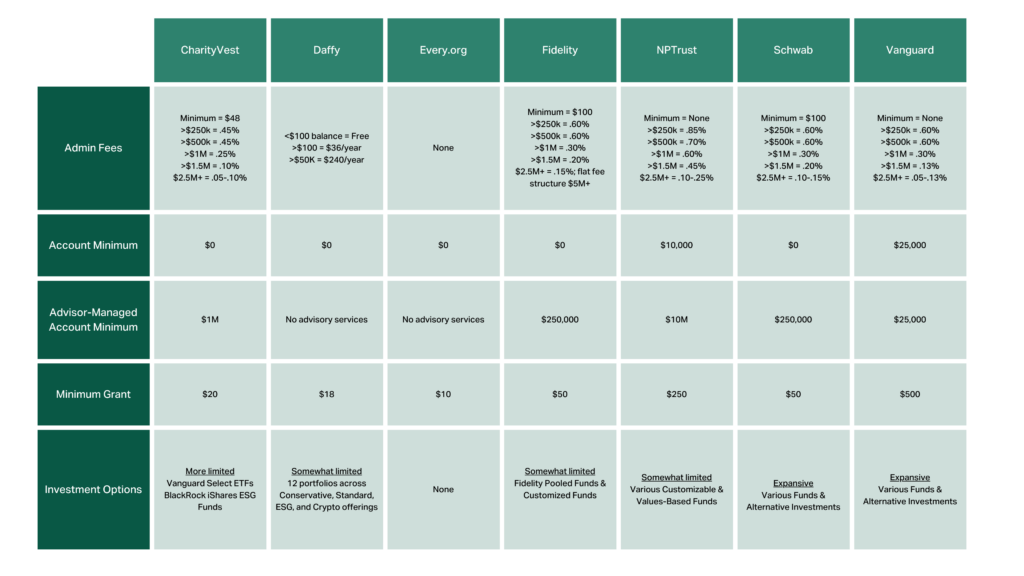

- What you will be paying in fees: DAF sponsors earn money from fees and typically charge a combination of administrative or account maintenance fees plus investment fees. Some DAFs may offer reduced maintenance fees depending on the size of your fund. Investment fees are charged as a percentage of your investments, so you should check what the expense ratios are on the types of investments you may want to include in your DAF.

- Any required donation minimums: While there are numerous DAF sponsors, their minimum contribution sizes and grant sizes may vary. Some may allow you to set up an account with $0 and have $0 additional contribution minimums while smaller DAF sponsors can have minimum contribution sizes over $100,000. Some DAFs may also require minimum grants of $500 or more, which could be an issue if you plan to make relatively small contributions.

- Your desired investment options: Different DAF sponsors may offer different types of investment vehicles, including stock and bond mutual funds, asset allocation funds, real estate funds, hedge funds, and more. Before choosing a DAF, you should verify that the fund can accommodate the types of investments you plan to make.

See the chart below for reference on the various fees, minimums and grant sizes for different DAF sponsoring organizations, or check out the Effective Altruism Forum’s comparison of DAF providers for additional context.

2. Fund your DAF and claim your tax deduction

Once you make a contribution to your DAF with any allowable assets, you’re allowed to take an immediate tax write-off for the full amount of your contribution. For cash contributions, you’re eligible to deduct up to 60% of your adjusted gross income (AGI). For non-cash and appreciated asset contributions, you’re allowed to deduct the full fair-market value of the asset up to 30% of your AGI.

Note that DAF contributions are irrevocable, meaning that once you make a contribution you are unable to withdraw the funds. After you make the donation to your DAF, your sponsoring organization has legal control over the funds.

Consult the latest IRS guidance for more information on tax deductions and DAF restrictions.

3. Make grants and investments through your DAF

Once your DAF has been funded, you’re able to decide how you’d like to allocate the funds without the urgency of a tax deadline.

Typically there are no restrictions on when to give, but you should confirm that with your sponsor to ensure that their offerings align with your charitable giving timeline. Most DAFs will honor grant recommendations to any qualified 501(c)(3) public charity, but you should confirm the eligibility of your charities of choice before committing any funds to a DAF.

Advantages of DAFs

Donor advised funds can be an easy and tax-efficient way to support the charitable organizations of your choice. Here are some possible benefits of setting up a DAF:

1. Contributions to DAFs are generally tax-deductible

DAF tax deductions function similarly to standard charitable giving rules – donations to donor-advised funds are tax-deductible up to 60% of AGI for cash gifts and up to 30% of AGI for non-cash gifts.

You can claim a tax write-off in the year you make your contributions rather than when you choose to send those contributions to charity. This could help reduce your tax burden after a liquidity event like an Initial Public Offering (IPO) or other financial windfall. You should consult with a tax or financial professional on whether this is the appropriate tax strategy for your situation.

Contributions to DAFs through any of the following assets are eligible for a tax deduction:

- Stocks (public and private or restricted), bonds, and mutual funds

- Individual retirement account (IRA)

- Life insurance

- Real estate

- Pre-IPO shares and partnership interests

- Cryptocurrencies

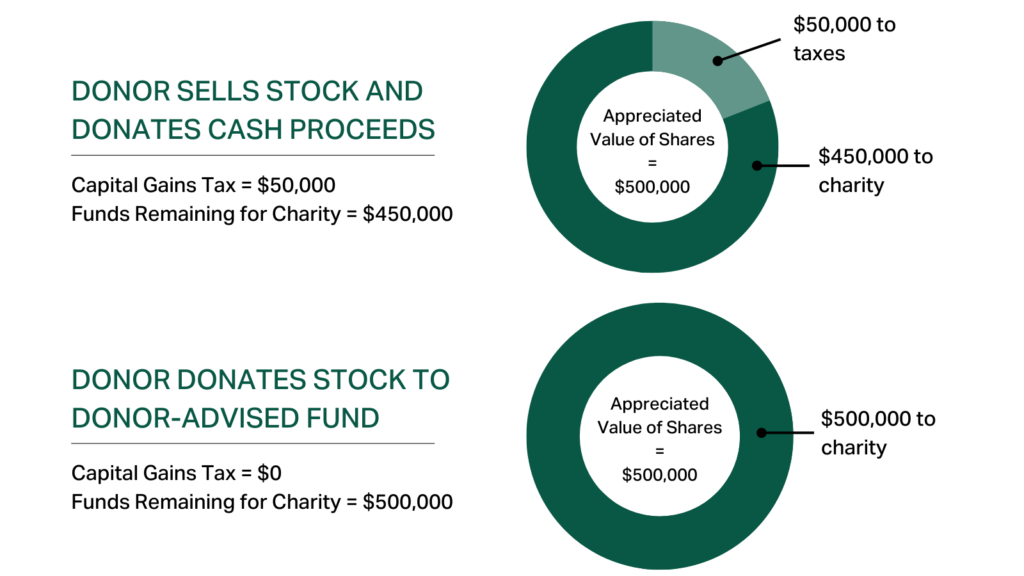

2. Contributions of non-cash assets to DAFs are not subject to capital gains tax

Provided they’ve been held for over a year, contributions of publicly traded securities or other illiquid assets to a DAF will not incur capital gains tax. This could allow you to eliminate the capital gains tax that may have been incurred if you had sold an appreciated security and then donated the proceeds to charity. It may also help reduce the marginal income tax liability you incur from the sale of an appreciated asset.

The example below shows the tax implications of donating appreciated stock to a DAF versus liquidating the security and donating the after-tax proceeds to charity.

3. Contributions to DAFs are not subject to estate taxes

In other words, the funds you’re holding in a DAF don’t add to your total estate value and may therefore reduce the size of your taxable estate.

4. Investments made with DAFs can grow tax-free

Invest your funds in any available vehicle without worrying about the tax implications.

5. DAFs offer tax benefits even if you don’t itemize every year

Via a tax strategy known as ‘bunching’, which has been a common approach since the Tax Cuts and Jobs Act (TCJA) increased the standard deduction. Under tax bunching, you alternate between taking the standard deduction and itemizing deductions to maximize your tax benefits.

- For example, let’s say you expect to make annual cash donations of $20,000. If your standard deduction is $25,900 as a married couple and you have no other itemized deductions, you obtain no tax benefit from your charitable donation in Year 1 by itemizing the $20,000 donation.

- Instead, you can hold onto your donation until the next tax year where you then ‘bunch’ two years worth of donations, so instead you contribute $40,000 to a DAF. This gives you both the tax benefit of the standard deduction of $25,900 in Year 1 and the itemized deduction of $40,000 in Year 2. Bunching via a DAF will also give you the practical benefit of still being able to spread your donations over time.

6. DAF donors can remain anonymous

Because contributions from a DAF to a charitable organization are sent from the sponsoring organization, donors may remain anonymous if they choose. Charities will typically send receipts and relevant tax documentation for tax deduction purposes to the sponsoring organization, which will pass them on to donors.

In contrast, private foundations are legally required to make their donor information publicly available, so anonymity is typically not an option.

7. DAFs are relatively easy to set up

In comparison to other charitable giving vehicles like private foundations, DAFs can be established in a short period of time, sometimes immediately, at a lower cost relative to other vehicles.

8. DAFs offer flexibility in the timing of your donations

When you give to a DAF, you receive immediate tax benefits but are under no obligation to choose the benefiting charities when you establish the fund. This gives you time to identify the charity of your choice, which can be particularly useful in a liquidity event where you suddenly receive large amounts of money (such as from an IPO, inheritance, business sale or property sale). If you’re not ready to choose where to give in the immediate aftermath, a DAF could be a good option to give you the time to research and consider your giving options.

9. You can donate real estate to a DAF

Many people can end up in the situation where their real estate property has appreciated in value, however the expense and maintenance required to upkeep the property make it no longer feasible to hold as an investment. Donating real estate to a DAF can offer a reduction in taxable real estate value while providing the same benefits as a stock contribution.

Disadvantages of DAFs

1. Loss of control to sponsoring organization

Since contributions to DAFs are irrevocable, once the funds are sent to the DAF sponsor they are “locked” in their entirety. Donors are then advisors in the administration and disbursement of the funds in their DAF, and the sponsor has the legal right to approve or reject recommendations on investments and grants.

This also means that if the DAF sponsor encounters financial hardship, donors have no control over their previously contributed funds. For example, in 2009 the National Heritage Foundation was sued by donors after going bankrupt. As a result of its bankruptcy, 9,000 DAFs totaling $25 million in value were wiped out according to reporting by the New York Times.

2. Grants must be made to IRS-qualified charities

Grants made through DAFs are limited to IRS-eligible 501(c)(3) charitable organizations. Contributions to individuals are not permitted.

3. DAF donors can’t receive certain benefits from their donation

Donors are not permitted to receive any goods or services from the charitable organization in exchange for contributions made through a DAF, like a ticket to a donor event that they would otherwise need to pay for.

Criticism of DAFs

In addition to the functional disadvantages of DAFs, they have been the subject of criticism from some journalists, legislators, and philanthropists. Some critics have stated that funds that could have been directed to charitable organizations and people in need are used to cover the fees of DAF organizations. Another criticism of DAFs is that because there is no restriction on when grants must be made, they delay the transfer of funds to non-profits and individuals in need, which can reduce their overall effectiveness as a vehicle for charitable impact.

There has also been criticism over situations in which donors advise sponsors to sit on their assets, owing to a psychological “endowment effect” whereby the nature of the fund can make some donors feel as if their donation is a charitable asset in which they have a continuing interest. This can reduce charitable effectiveness when donations are being held in the fund for long periods as opposed to being directly donated.

However, some newer DAFs like Every.org seek to expedite and maximize funds directed to charity by minimizing fees for nonprofits and not offering investment options for donors.

Major DAF providers

Here is a list of select financial institutions that offer donor advised funds:

- CharityVest

- Daffy

- Every.org

- Fidelity Charitable

- Goldman Sachs Philanthropy Fund

- Greater Kansas City Community Foundation

- National Christian Foundation

- National Philanthropic Trust

- Network for Good

- New York Community Trust

- Schwab Charitable

- Silicon Valley Community Foundation

- Vanguard Charitable Endowment Program

This content is for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice. Nor does this information constitute an endorsement or recommendation of any financial institution or an offer to buy or sell any securities or other financial instruments. The investments or other strategies mentioned herein do not take into consideration your particular investment objectives, financial situation or needs and may not be suitable for you. You must make an independent decision regarding any financial or investment strategies mentioned herein and should consult a legal, financial or investment advisor before making any financial decisions.

FAQs about donor-advised funds

Can I donate to GiveDirectly via a donor-advised fund?

Yes, we accept grants from DAF-sponsoring organizations and other giving vehicles. Reach out to info@givedirectly.org with any questions.

You can also make donations via our secure donation page. We accept:

- All major credit and debit cards

- PayPal

- Checks

- Wires

- Stocks and mutual funds

- BTC, ETH and other cryptocurrencies

How long can I keep money in a donor-advised fund?

You are generally able to keep funds in a DAF for as long as you’d like. You can ensure that your philanthropic goals are met beyond your lifetime by including grant recommendations or other allowable DAF designations in your estate planning process.

What types of assets can I contribute to a donor advised fund?

DAFs commonly accept assets like checks, bank wires, and bank transfers. If you intend to donate any of the following non-cash assets, you should confirm which sponsors will accept them:

- Mutual fund shares

- Stocks and bonds

- Private equity and hedge fund interests

- Cryptocurrencies

- Partnership interests

- Life insurance

- Trusts

- Real estate

- Other investment assets

How do I report contributions to a donor advised fund?

To claim the tax write-off, you’ll need to include your contribution in the IRS Form 1040 for the year in which you make the donation. Your DAF sponsoring organization should provide a receipt for your donation which may be needed to substantiate the donation.

What if my donor-advised fund donation exceeds my allowable deduction?

You typically have five years to claim any unused deductions if you exceed your annual deduction limit. This is known as tax carryforward.

What happens to a donor-advised fund at death?

Typically, a donor advised fund is treated like part of the donor’s estate. It should be included in an estate planning process to ensure that any funds remaining after a donor’s passing are allocated according to their wishes.

How much can I contribute to a donor-advised fund?

There is no contribution limit to most DAFs, but tax deduction limits still apply.

Why use a donor-advised fund?

Donor advised funds are a popular choice among donors seeking the immediate tax benefits of a donation without committing where and when to give. They also enable anonymous donations and tax-free investment of your charitable dollars.

What is Form 8283?

Form 8283 is used to report information about non-cash charitable contributions when the deduction amount for all non-cash gifts is more than $500.

When is Form 8283 released?

Tax forms are typically sent at the beginning of the year. You should confirm the timing with your brokerage or DAF sponsoring organization.

What should I name my donor-advised fund?

That’s up to you. Note there may be character limitations from your sponsoring organization.

Can I make pledges from my donor-advised fund?

You can’t make a legally enforceable pledge from a donor advised fund, but you can typically direct funds from your DAF to fulfill a non-binding pledge. See IRS Notice 2017-71 for more information on personal pledges.

If my contributions to the DAF appreciate in value after I have donated, will I have any income tax or capital gains obligations?

No. Your contributions to your DAF will appreciate in value tax-free. So in the event of asset appreciation, the ultimate beneficiaries of the donation may end up receiving more than your initial donation, at no additional cost or tax burden to you.

Is there a minimum required donation amount that DAF donors must make?

This depends on the plan sponsor. In some cases, there are no minimum amounts, but internal sponsor policies are flexible and subject to change. You should reach out to your sponsoring organization to confirm their donation minimums.