You’ve likely been impacted by the cost of living crisis: U.S. gas prices spiked this summer and energy prices are still at all-time highs across Europe. While overall inflation in high-income countries is at 6%, in low-income countries it’s at 9%. Consumers in wealthy countries can often switch from higher-quality goods to lower-quality ones, an option not possible for recipients like Josphat.

Inflation is worse for those who were already unable to afford their basic needs. Below we explain the conditions on the ground, how we’re responding, and how you can help.

Drought and price inflation are threatening lives

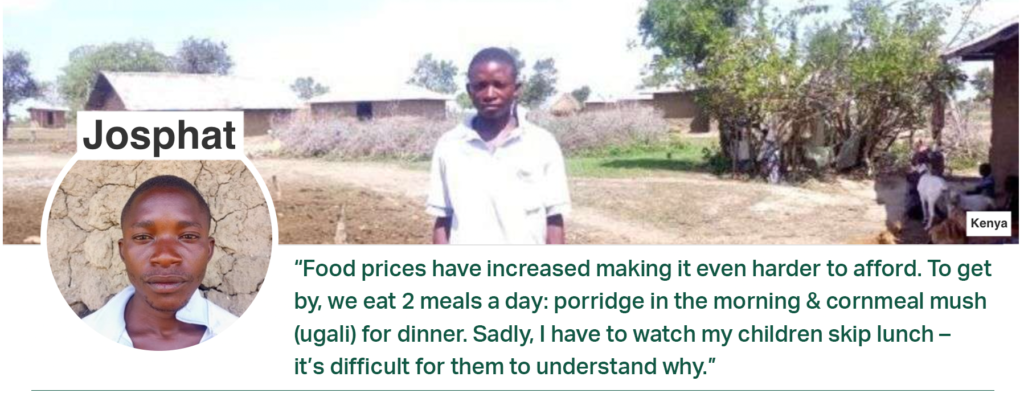

“The past four seasons have been harsh since we have not had any harvests. Food has been scarce and we have been compelled to purchase from shops,” Josphat told our field team. Persistent drought in his home of Kilifi, Kenya and through East Africa has killed off livestock and crops. At the market, Josphat is seeing the cost of maize flour, a main staple, double this year, rising by 50% in June alone.

“Due to the high commodity prices, my family had run out of food five days before the transfer arrived, leaving us sleeping hungry consecutively, ” says Dama, who receives $26/month from a GiveDirectly donor. She’s currently foregoing school fees for three of her kids and health treatment for her one year old. Famine threatens most of the areas we deliver donations across East Africa and Yemen. You can read more stories like Josphat’s and Dama’s here.

Even as need grows, 40% fewer donors have given directly as compared to this time last year, likely due to their own financial constraints. We understand not everyone can give, but encourage those who can to send funds directly to someone facing much worse inflation conditions.

Giving directly helps people weather inflation better than other aid

Having more money allows people in poverty to build resilience despite rising prices in more ways than you might expect.

- Feed your family a diverse diet. Lawrence earns half as much driving his tuk-tuk taxi as he did before fuel prices jumped. He used most of his $26 monthly transfer to feed his family of nine. Research shows cash aid will not only increase how much his family eats, but also the diversity of their diet – something food aid (often wheat) might not achieve – which means they are less likely to fall ill and need costly medical treatment.

- Pivot to more profitable businesses. High food and fuel prices made Dama’s vegetable shop unprofitable. Drought hurt coconut yields, interrupting her husband’s palm wine business. She spent part of a monthly transfer on chickens, in her words “an investment for the future when they multiply and an alternative source of income when I sell some.” In volatile markets, funds to pivot to new businesses can improve resilience much faster than new job training, and research has found simple cash transfers can work better than job training at increasing incomes long-term.

- Maintain children’s education. Dama also has three school age children. With dropping profits from her and her husband’s businesses, she’s been struggling to pay down school fee debt. She said, “I have been unable to raise funds to support my family. As a result, my daughter was sent home, but supporting her proved difficult. When I got my monthly transfer, I used it all to pay her fees, and am glad she is getting enough time in school.” Research finds a girl in Kenya completing one year of secondary education can increase her future wages by over 25%.

Evidence shows our cash transfers don’t worsen inflation

As pundits debate if government pandemic payments in high-income countries contributed to inflation, it bears repeating the evidence showing GiveDirectly’s cash transfers have a positive impact on local economies in low-income countries and don’t create inflation.

In 2014, GiveDirectly partnered with researchers to study how large transfers affect local economies: 10,500 poor households across 653 randomized villages in rural Kenya received a one-time $1000. This amount of money was significant: about 15% of local GDP. After 2.5 years of monthly surveys of businesses and households, researchers found an average price inflation of just 0.1% adding, “even during periods with the largest transfers, estimated price effects are <1%.”

They also found cash transfers had a “multiplier” effect of 2.5x. This means that every $1 of cash delivered generated $2.50 in additional spending or income for the larger economy, benefiting those who received funds and those who did not.

Edit: Dec. 2022 – inflation trends in Kenya.