Ways of charitable giving

Guide to planned and legacy giving

Planned or legacy gifts can be a tax-efficient and impactful way to support the charitable cause of your choice. Here’s a basic definition for each type of gift:

- Planned gifts: any charitable contribution planned now to be made later.

- Legacy gifts: donations granted after the donor has passed away.

Legacy gifts are often included in a planned giving strategy to ensure that the donor’s charitable objectives are met without the delay and cost of the probate process.

Here’s an overview of several planned or legacy giving vehicles, including:

- Bequests

- What types of bequests are available

- What are the advantages of making a bequest

- How to set up a charitable bequest

- Charitable trusts

- Charitable gift annuities

- Life insurance donations

- Retirement asset donations

- Retained life estate donations

- Frequently asked questions about planned and legacy giving

This content is specific to U.S. tax law – refer to IRS Publication 526 for more information and official guidance. You should consult with a financial advisor or tax professional for advice on your individual situation before making any investment decisions.

What is a bequest?

Bequests or bequeathments to charity are gifts made as part of a will or trust during the estate planning process. Just as you’re able to leave cash and non-cash assets to heirs and loved ones, you can choose to bequest any amount to the nonprofit organization of your choice to ensure that your legacy includes a commitment to charitable impact and advancement of social good.

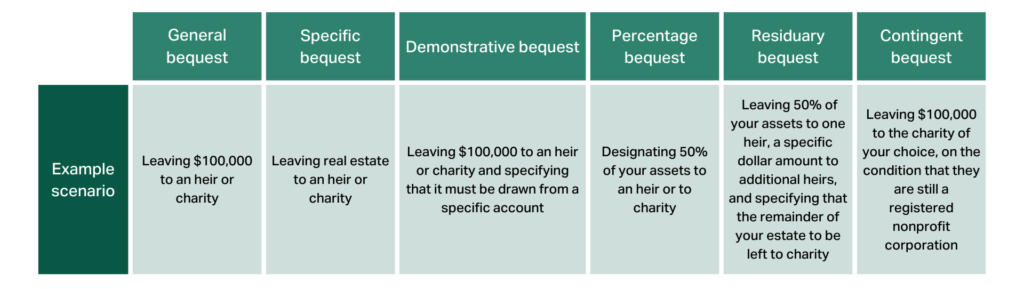

There are multiple types of bequests to consider when estate planning, and charitable bequests can fall into any of these categories:

- General bequests: Gifts of a specific dollar amount.

- Specific bequests: Gifts of a non-monetary asset.

- Demonstrative bequests: Bequests that include instructions for how the gift should be distributed or where it should be drawn from.

- Percentage bequests: Gifts that designate a portion of your overall estate or asset portfolio, rather than a specific dollar amount or by asset. This is most commonly used to divide assets among a pool of heirs or beneficiaries and may require the executor of your estate to liquidate assets to facilitate distribution.

- Residuary bequests: Gifts that designate where to send any remaining assets after all other bequests have been made.

- Contingent bequests: Bequests that include specific conditions that must be met in order to proceed with the distribution of the gift.

Here are example scenarios to help you understand the basic differences between these bequests:

Advantages of charitable bequests

Charitable bequests can allow you to make a lasting impact on the organizations and causes you support while potentially unlocking significant tax benefits.

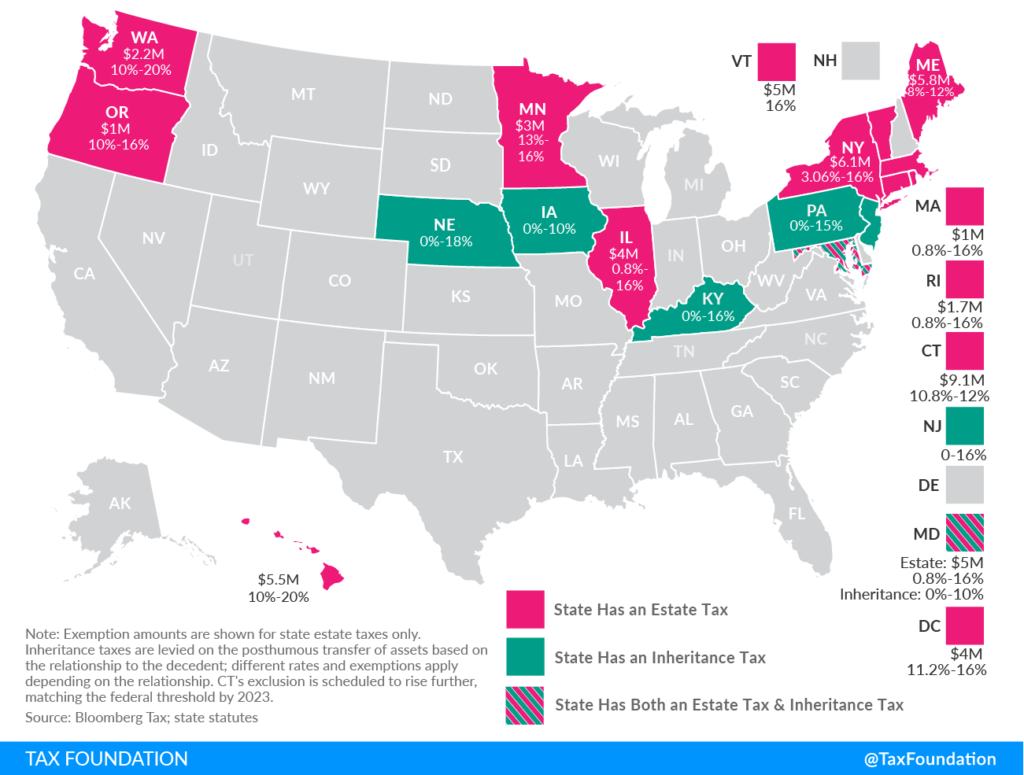

According to the latest IRS guidance issued in 2022, any estate exceeding $12.06 million will owe an estate tax, also known as a death tax. The current federal estate tax rates are on a sliding scale from 18% to 40%, with several states imposing additional estate taxes and/or inheritance taxes, which are imposed on the heirs to an estate.

There are currently 17 states that impose an additional estate and/or inheritance tax. See this map to check state estate and inheritance tax rates and exemptions in 2022:

Setting up a charitable bequest of financial or other assets in your estate will typically reduce the overall value of your estate. This is one way to consider reducing or avoiding estate taxes.

How to make a charitable bequest

In order to make a bequest to charity, you can prepare a new will with the support of a lawyer or online service like FreeWill or make an amendment to your existing will with a subsequent will or through a codicil. A codicil is a legal supplement that allows you to make relatively minor changes or additions to your will. You should consult with a lawyer in your jurisdiction on how to validly draft or amend your will based on your specific state laws and individual circumstances.

If you intend to make a charitable bequest, you should reach out to the charity or charities of your choice to ensure they are able to accept and use your gift as intended. If you’d like to make a bequest or bequeathment to GiveDirectly, you should consult with your lawyer, but here is an example of phrasing including the information typically required for designation:

You can reach out to us at [email protected] for additional information on making bequests to GiveDirectly.

What is a charitable trust?

Charitable trusts are financial vehicles that allow donors to transfer gifts to charities at multiple points over time.

What are charitable gift annuities?

A charitable gift annuity, or CGA, operates similarly to other financial annuities that offer a guaranteed income stream. In the case of charitable annuities, donors set up an annuity agreement with the charity of their choice, make an irrevocable, lump sum contribution to the annuity, and then receive regular payments. Upon the donor’s death, the charity receives any assets remaining in the annuity.

Note that charitable gift annuities are regulated at the state level and tax implications may vary based on the structure of the annuity. The amount of annuity payments can also vary based on actuarial considerations like the initial contribution level and age of the annuitant.

You can use this charitable gift annuity calculator to estimate your tax deduction, annuity payments and total charitable contribution based on your target gift amount.

What is a life insurance donation?

Making charitable donations through life insurance is a popular form of planned giving that can carry advantages in the form of reduced estate taxes or more immediate tax benefits. Life insurance giving can fall into the following categories:

1. Charitable benefit riders

An insurance policy rider is any policy provision that amends the coverage terms in order to customize your policy. Under a charitable benefit rider, or charitable giving rider, you can designate a specific amount or percentage of your policy’s value to be donated to the IRS-qualified charity of your choice after death.

2. Policy donations

Gifting your insurance policy involves transferring ownership of the policy directly to the charity of your choice to ensure they receive the entire payout amount, or death benefit, of the policy after your death. If the policy has cash value, the charity would also have the option of surrendering the policy in order to access the present cash value. Once you transfer ownership, you may be entitled to take tax deductions on any policy premium payments made after the gift. There could also be significant estate tax benefits, as donating the policy will reduce your taxable estate value.

3. Naming a charity as your life insurance beneficiary

Much like you can name an individual the beneficiary of your life insurance policy, you can also designate a charity as your beneficiary to donate the policy’s death benefit. Unlike donating the policy, this option won’t offer the same short-term tax benefits on any premium payments but will reduce your taxable estate value once the death benefit donation is made. Note that you also have the option of naming a charity as a revocable beneficiary, which creates flexibility in case you may want to change beneficiaries in the future.

4. Gifting life insurance dividends

If you receive dividends from your life insurance policy, you may be able to donate current dividends and any pooled prior dividends to charity. While taking dividends can reduce the death benefit associated with a policy, you would be eligible to take tax deductions for donating any dividends to charity.

What is a retirement asset donation?

A retirement asset donation is any contribution made directly from an Individual Retirement Arrangement (IRA), 401(k), and 403(b) to a qualified charity. One of the most common forms of retirement asset donation include qualified charitable distributions (QCDs), or charitable IRA rollovers, under which you can begin donating to the charity of your choice during your lifetime. Additionally, you are able to designate a qualified charity as the beneficiary on most retirement accounts through the plan administrator. Retirement asset donations made through this beneficiary designation will likely also help reduce your estate tax liability.

What is a retained life estate donation?

Under a retained life estate donation, a donor will transfer a property deed to a charity but preserves the legal right to live on the property for the rest of their life or a spouse or beneficiary’s life. You are eligible to make a retained life estate donation using a primary residence, vacation home, farm, commercial property, or undeveloped land. Tax benefits may include receiving an immediate income tax deduction, avoiding capital gains tax on appreciated real estate assets, and reducing your estate tax burden.

You can use this retained life estate calculator to estimate your potential income tax deduction based on your age and property value.

This content is for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice. Nor does this information constitute an endorsement or recommendation of any financial institution or an offer to buy or sell any securities or other financial instruments. The investments or other strategies mentioned herein do not take into consideration your particular investment objectives, financial situation or needs and may not be suitable for you. You must make an independent decision regarding any financial or investment strategies mentioned herein and should consult a legal, financial or investment advisor before making any financial decisions.

FAQs about planned and legacy giving

What type of charitable donation is best?

This depends on your financial situation and philanthropic goals.

You should consult with a legal or tax professional on your individual circumstances and consider conducting your own research on charitable tax strategies and the advantages and disadvantages of giving vehicles like donor-advised funds, bequests, and more.

What’s the difference between estate taxes and inheritance taxes?

Estate taxes are imposed directly on the value of the estate and paid by the estate before assets are distributed to beneficiaries.

Inheritance taxes are imposed on beneficiaries when they receive their inheritance and are calculated on the basis of their allotment, rather than the entire estate.

Do charities pay inheritance or estate taxes?

No, as long as the charity is IRS-qualified they will not incur any estate or inheritance taxes on a legacy gift.

Can you change a bequest?

Yes, you can typically modify any charitable bequest within your estate plan unless it is specifically irrevocable.

What types of planned and legacy gifts does GiveDirectly accept?

Donations made via donor-advised fund, bequest, and most other giving vehicles are welcome. We also accept the following types of gifts:

- All major credit and debit cards via our secure donation page

- PayPal

- Checks

- Wires

- Stocks and mutual funds

- BTC, ETH and other cryptocurrencies

Reach out to [email protected] with any questions on ways to give.

Can I donate the annual dividends from my life insurance policy?

Yes, if your insurance policy has a cash value component that pays out dividends, you may be able to cash the check and donate the proceeds to charity.

Can I create a retained life estate with a second home?

Yes — under certain IRS rules, including stipulations that the property cannot be owned under a corporate structure and depreciation tax deductions cannot be taken. Note that the home does not necessarily have to be a house – motorhomes may qualify, as well as some yachts and boats.

After making a retained life estate donation, can I move out of the house and move back in at a later date?

Yes – the use of the home is at your discretion during your lifetime.

If I have made a retained life estate donation, what happens if I want to move out of the property during my lifetime?

This depends on the provisions negotiated in the contract – you may have the right to lease the property for the remainder of your life estate while retaining responsibility for tax, insurance and other related property costs as agreed with the charity in the contractual agreement.