Ways of charitable giving

Guide to qualified charitable distributions

Qualified charitable distributions (QCDs) can be a helpful way to lower your annual gross income and reduce your tax liability by making donations directly from your individual retirement account (IRA).

Here’s what you need to know if you’re considering using your retirement assets to support the philanthropic cause of your choice.

- What is a qualified charitable distribution, or charitable IRA rollover

- How to make a QCD

- Where to make a QCD

- Tax benefits of QCDs

- Frequently asked questions on QCDs

This content is specific to U.S. tax law – refer to IRS Publication 526 for more information and official guidance. You should consult with a financial advisor or tax professional for advice on your individual situation before making any investment decisions.

What is a qualified charitable distribution?

Qualified charitable distributions (QCDs), or charitable IRA rollovers, are donations made directly from a traditional IRA, inactive SEP IRA, inactive SIMPLE IRA, or other retirement plan account to the qualified charity. Making QCDs can be a tax-efficient strategy for those who have reached the age where you have to take required minimum distributions (RMDs) but either don’t need the money or want to reduce your overall tax liability.

Due to the SECURE (Setting Every Community Up for Retirement Enhancement) Act of 2019, all traditional IRA owners must begin taking a required minimum distribution from your IRA by April 1st of the year after you reach 72 or incur tax penalties. Note that Roth IRAs do not have a minimum withdrawal requirement. These withdrawals are typically included in your taxable income, but through a QCD you can donate up to $100,000 from your account to an IRS-qualified charity to lower your adjusted gross income (AGI) and earn a tax break on your required minimum distribution.

You can use an IRS worksheet or consult this table to calculate your required minimum distribution.

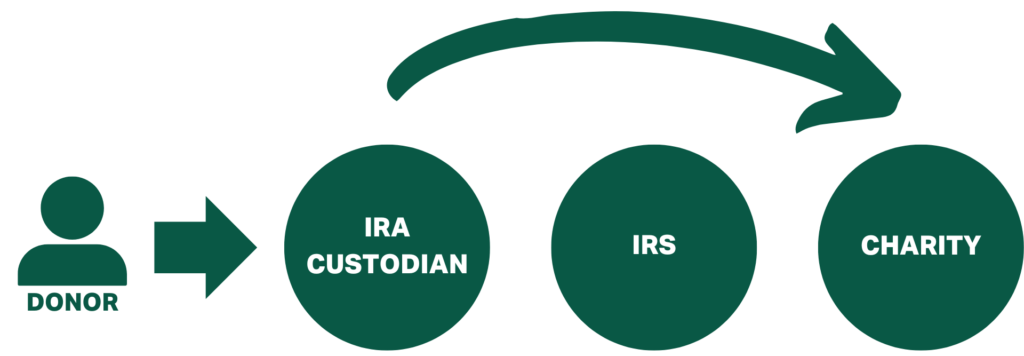

How to make a qualified charitable distribution

If you have an IRA, SEP IRA, or other qualifying retirement account, you can make a charitable IRA rollover starting at age 70 ½ and above. Individuals are eligible to donate up to $100,000 per year or $200,000 per year from each spouse in a married couple filing jointly.

The donation can be made directly by the IRA custodian or plan administrator, either by sending a check or wire to the charity or sending it to the account owner to pass directly to the charity of their choice. You can support multiple charities through QCDs in a given year, as long as the total distributions don’t exceed the $100,000 annual limit.

You should keep donation receipts for reporting purposes and must make QCDs by the distribution deadline for it to apply towards your RMD, which is typically on December 31st in a given tax year. Given that contributions are made by your IRA administrator, you should plan ahead to ensure that your QCD is eligible for a tax deduction before the end of the year. Remember that payments must be made in the charity’s name, otherwise it will be considered taxable income.

Where to make a qualified charitable distribution

GiveDirectly and other IRS-qualified 501(c)(3) organizations are generally able to accept IRA charitable rollovers. Note that you cannot make QCDs to donor-advised funds and private foundations at this time.

Tax benefits of qualified charitable distributions

Making qualified charitable distributions (QCDs) from your IRA can have a number of tax advantages, depending on your situation. Here are some potential tax benefits of a QCD:

1. Lower your annual gross income

While everyone over the age of 72 is required to take required minimum distributions (RMDs) from specific retirement accounts, it may not be beneficial for your tax situation given that RMDs are subject to income tax.

This additional income has the potential to push taxpayers into a higher tax bracket or could trigger phaseouts, in which income increases reduce your eligibility for tax credits. By making QCDs, you can fulfill your minimum distribution requirements and reduce your taxable income.

2. Exceed your maximum allowable deductions from other donations

Qualified charitable distributions are not subject to the same charitable deduction maximum as individual charitable contributions because they are sent directly from the retirement account. For reference, in 2022 you will only be eligible to deduct anywhere from 20% to 60% of your adjusted gross income (AGI) for cash donations and likely up to 30% of AGI for donations of non-cash assets. This means that even if you have maxed out your tax deductions from charitable contributions through other means, you are still able to make an impactful gift that can reduce your overall tax liability through QCDs.

3. Claim benefits without itemizing

Qualified charitable distributions could also be beneficial if you’re retired with a low adjusted gross income. Since you’re generally only eligible to deduct up to 60% of your AGI, if you have little to no active income you may regularly exceed this amount with your charitable contributions. In this scenario, it could be more beneficial to make a charitable IRA rollover after meeting your maximum deduction or if you are taking a standard deduction instead of itemizing.

4. Lower future required minimum distributions

Because RMDs are calculated on the basis of your IRA balance, leveraging your IRA funds to make a qualified charitable contribution can also reduce your future required distributions. This can be helpful if you are considering ways to lower AGI over time to reduce your tax liability.

Note that while IRA distributions to a qualified charity are tax-free, you will not be eligible to use QCDs to both lower your annual gross income (AGI) and claim a tax deduction on that charitable contribution. You can still claim tax deductions on other donations made from different funding sources, regardless of whether you’re making QCDs.

This content is for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice. Nor does this information constitute an endorsement or recommendation of any financial institution or an offer to buy or sell any securities or other financial instruments. The investments or other strategies mentioned herein do not take into consideration your particular investment objectives, financial situation or needs and may not be suitable for you. You must make an independent decision regarding any financial or investment strategies mentioned herein and should consult a legal, financial or investment advisor before making any financial decisions.

FAQs about qualified charitable distributions

Can I donate to GiveDirectly via qualified charitable distribution?

Yes, we accept contributions via QCDs.

You can also make donations via our secure donation page. We accept:

- All major credit and debit cards

- PayPal

- Checks

- Wires

- Stocks

- BTC, ETH and other cryptocurrencies

- Grants from DAF-sponsoring organizations and other giving vehicles

Reach out to info@givedirectly.org with any questions on how to give.

What is the maximum QCD amount?

Can I use a Roth IRA to make qualified charitable distributions?

Technically, no. While you can use Roth IRA funds to donate to charity and may be eligible to claim a tax write-off on those donations, Roth IRAs do not have required minimum distributions.

Can I make qualified charitable distributions to multiple charities?

Yes, you can make charitable IRA rollovers to any IRS-qualified charity.

What age can I start making qualified charitable distributions?

70 ½. The SECURE Act changed the RMD starting age to 72, but it did not impact the QCD starting age.

Are QCDs better than simply making a charitable donation?

Maybe, depending on your situation – if you’re in a high tax bracket, QCDs can help reduce your taxable income by the amount of your required minimum distribution. Other types of donations also require itemizing on your tax return in order to claim the tax benefit, while QCDs do not.

Can a QCD satisfy the required minimum IRA distribution?

Yes — QCDs can cover part of all of your required minimum distribution.

How are QCDs reported to the IRS?

Charitable distributions are reported on Form 1099-R for the tax year in which the distribution is made. You should not have to fill this out yourself as most providers will automatically send you the form whenever you direct your distributions to be donated.

How do I report a QCD on my tax return?

On your Form 1040 tax return, you can report the full amount of the distribution on the line for IRA distributions. Under ‘taxable amount’, you can enter zero if the full amount was made as a qualified charitable distribution. You can add ‘QCD’ next to this line to designate why it’s non-taxable.

How do I make a QCD from an IRA?

You should get in contact with your IRA custodian and make a request in writing, specifying the amount you want contributed to each charity. Always maintain receipts and records so you can accurately report this on future tax returns.