Financials

What does GiveDirectly do with my donation?

Non-profit finances are often opaque and complex. We aim to be transparent and straightforward. Got an idea for how we can improve this page? Email [email protected].

We update this page when we release the prior year’s financial statements and 990 tax filing here →

We send about $8 out of every $10 directly to the world’s poorest

We deliver your donations as unconditional cash to the world’s poorest households, typically as ~$1,000 per family. Hundreds of research studies show they use these funds to make long-term improvements to their income, assets, education, food security, psychological well-being, and their children’s growth.

💸 vs.🥫 Read why direct cash is more cost-effective than many other forms of aid →

These are the findings of a comparison study of six months of emergency food aid 🥫 vs. cash aid 💸 to Yemeni families during the 2011 lean season:

| Delivery costs | Impact | Flexibility | Preference | |

|---|---|---|---|---|

| $150 of food aid 🥫 | It costs $0.24 to deliver $1 of food | Compared to cash aid, families getting food improved diets less | N/A | Less than a quarter of families wanted their aid entirely as food |

| $150 of cash aid 💸 | It costs $0.11 to deliver $1 of cash | Compared to food aid, families getting cash improved diets more | Families chose to spend 12% of the cash on non-food needs like transport and repaying debts | Two-thirds of families wanted their aid entirely as cash |

| Cash is more efficient | Cash is more impactful1 | Cash is more flexible | Cash is more preferred |

This is just one of the 500+ studies on the impact of direct cash. Similar comparative advantages can be seen in studies between cash and job trainings or cash and nutrition programs.

We spend the remaining $2 of every $10 to deliver that cash

Safely delivering your cash to the world’s poorest comes with costs like transaction fees, offices, and staff both on the ground and those supporting globally. We measure fundraising costs separately.

Most charities don’t show their costs, they show “overhead” vs. “programs,” obscuring how much actually reaches the people they’re helping.

We don’t think “overhead” is a useful measure because:

- It’s open to manipulation. What’s spent on “programs” vs. what’s an “overhead” is not cut and dry. For example, Charity X could count a fleet of Land Rovers and the salaries of the contractors riding in them as “programs” and not as “overhead.”

- It hides bureaucracy. Often a different organization than the one you gave to is actually spending your donation. For example, Charity Y could simply re-grant your money to another organization that actually runs the program and count all of that “programs” spending, never telling you what that re-granted organization is using it for.

As a metric, “overhead” does not measure how much impact your donation had for the recipient. Our cost breakdown above shows the exact portion that reaches the recipient and the portion that covers operational expenses.

We work to deliver as much of your donation to recipients as possible

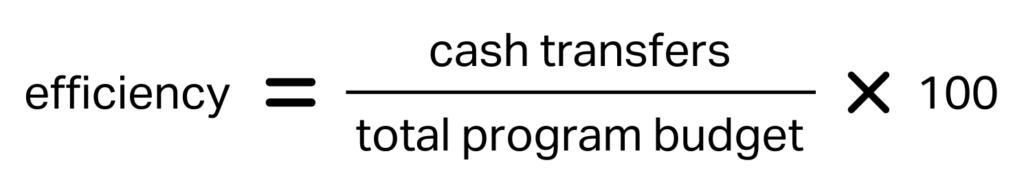

You can judge how well we’re controlling costs by looking at our efficiency, calculated as:

Minimizing costs maximizes our impact for the world’s poorest. But cost is not the only important metric, as some higher cost programs reach more vulnerable populations or unlock new funds to go directly to people in poverty.

That’s why we think showing you our efficiency by program type gives you a better, more nuanced picture of how we’ve been doing, rather than calculating it as a single org-wide number.

Click ➕ to read more about the efficiency of each program type:

Flagship poverty relief: 78% from 2021-23, we target ~85%

Our flagship poverty relief programs deliver large lump sums to Africans in extreme poverty in stable regions — a simple, cost-effective, and dignified way to make a difference.

Over the past three years, we’ve delivered 78% of funds to recipients. The chart below shows our efficiency by year. How we set our ~85% target →

Our efficiency has dropped recently (more below), and we expect to be back on track in 2025.

Bespoke poverty relief: 67% from 2021-23, we target ~75%

Our bespoke programs use novel ways to find, target, and support vulnerable African populations in poverty left behind by traditional aid. Typically, we codesign these programs with specific donors like government agencies.

Over the past three years, we’ve delivered 67% of funds to recipients. The chart below shows our efficiency by year. How we set our ~75% target →

Global emergency relief: 80% from 2021-23, we target ~60%

Our global emergency relief programs help people in moments of crisis extremely quickly, averting suffering and preventing them from falling into extreme poverty.

Over the past three years, we’ve delivered 80% of funds to recipients. The chart below shows our efficiency by year.

Our 3-year average efficiency was boosted from running large COVID-19 relief programs in 2021-22, which operated at a lower cost due to their scale. Today, we mostly run smaller programs in response to natural disasters, which have higher costs. How we set our ~60% target →

Our costs increased, and we have a plan to improve

Our flagship poverty relief and bespoke poverty relief program efficiencies dropped in 2023 as pandemic-fueled growth in donations significantly decreased.

We found it difficult to predict exactly where our ‘new normal’ for donations and operations would be following our rapid expansion during COVID-19 — a challenge faced by many nonprofits. We were trying to strike the balance between quickly delivering existing funds to recipients, retaining our core staff, and predicting future funding, all during an unprecedented period for fundraising.

Improvements are underway, and based on our current plans, we expect our efficiency to be back at a level we’re comfortable with in 2025 — read more →

Our flagship programs continue to be one of the world’s most effective solutions to poverty. In fact, the charity evaluator GiveWell more than tripled their estimates of our cost-effectiveness this year after reevaluating our work.

With more funding, we could reach 4x more of the world’s poorest by 2027

After a period of growth and stabilization, we’re well set up to deliver your donations to people in need as quickly and safely as possible. This means there is always more good to be done with more money.

The opportunity is huge. In 2023, GiveDirectly delivered $18M in cash transfers to ~62k people in Malawi, representing just 0.5% of the 13M in extreme poverty in that country. Last year, we also worked in the DRC, Kenya, Liberia, Mozambique, Nigeria, Rwanda, and Uganda, where another 175M people are living below the extreme poverty line.

We have the technical capacity to reach millions more people per year. Over the next 3 years (2025-2027), we could scale to deliver $1.4B – 4.5x more than we raised for our Africa programs in the last 3 years – while maintaining or exceeding our current operational quality.

Spending on fundraising maximizes dollars to the world’s poorest

We separate fundraising costs out from our programs’ efficiency because (i) they come from different funding sources and (ii) strong performance looks different for each.

The cost of fundraising (staff, our donation platform, etc.) is paid for by unrestricted donations (a.k.a., “where needed most”), not by donations to specific programs.

We work to use these funds wisely, tracking our cost per dollar raised (CPDR), defined as [fundraising costs] ÷ [total revenue raised]. We have one of the lowest CPDR in the industry; over the last 3 years, we spent $19M to raise $552M.

We use some unrestricted donations for fundraising because it’s one of the best ways to maximize dollars for the world’s poorest. Based on our historic CPDR, we expect $10k spent on fundraising can turn into $200k+ for people in poverty.

Notably, we’ve maintained an industry-low CPDR even while increasing our fundraising team. GiveDirectly started building this team in 2017, and has since seen a:

- 💰 275% increase in dollars raised ($49M/yr to $184M/yr)

- 👥 92% increase number of donations per year (13k to 25k)

- 📰 evolution of press asking “Is it nuts to give to the poor without strings attached?” to declaring “A revolution in helping Africa’s poor: Cash with no strings attached”

This means we’re getting a similar rate of return on our marginal investments, as growing the team has expanded our ability to maximize fundraising effectiveness (e.g., A/B testing). Support this work by giving “where needed most” →

Appendix: We also raise and deliver funds to low-income Americans

Since 2020, we’ve consistently delivered cash in the U.S. to create meaningful change in the lives of low-income Americans and the policies that impact them. This work has incubated tech innovations that benefit our global work and brought in new donors who then give to the world’s poorest as well.

Cash transfers and direct costs for this work are paid for by U.S.-only donations →

Footnotes

- Cash is more impactful, in this case, assuming improving dietary diversity and quality is your desired outcome: From the study: “Overall, cash transfers raised dietary diversity and quality more highly than food, and were cheaper to deliver and administer. Food beneficiaries, however, consumed more calories overall… On average, households that received cash exhibited greater dietary diversity, with differences driven largely by increases in consumption of protein-rich foods like meat and fish. However, food households consumed, on average, approximately 100 more calories per person per day than cash recipients, due largely to higher wheat flour and oil consumption.”